Make Smarter Trading Decisions

Kelor brings institutional-grade tools and insights to every trader, helping you make informed decisions across multiple exchanges.

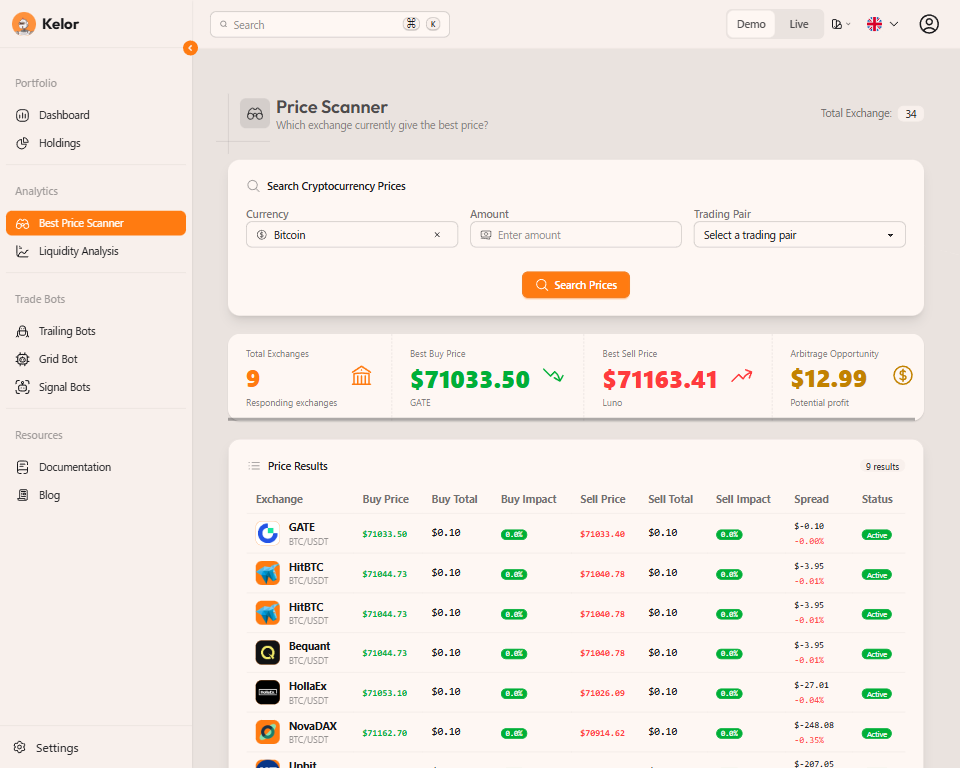

Information Aggregator

Compare prices, liquidity, and products across multiple crypto exchanges in one place. Get objective insights to find the best opportunities.

Advanced Trading Tools

Access features that exchanges don't always provide, like automated stop losses and trailing stops to protect your investments.

Test Before Trading

Backtest strategies and practice with paper trading—tools typically reserved for institutional traders, now available to everyone.

Objective Market Intelligence

At its core, Kelor is an aggregator platform that serves as your objective market informer. We collect and analyze data from multiple exchanges to give you a complete picture of the crypto market.

Best Price Discovery

Compare prices across exchanges to ensure you're getting the best rates for buying or selling.

Liquidity Analysis

Understand market depth and liquidity to make informed decisions about order sizes and timing.

Product Comparison

See which exchanges offer specific trading pairs, features, and products in one unified view.

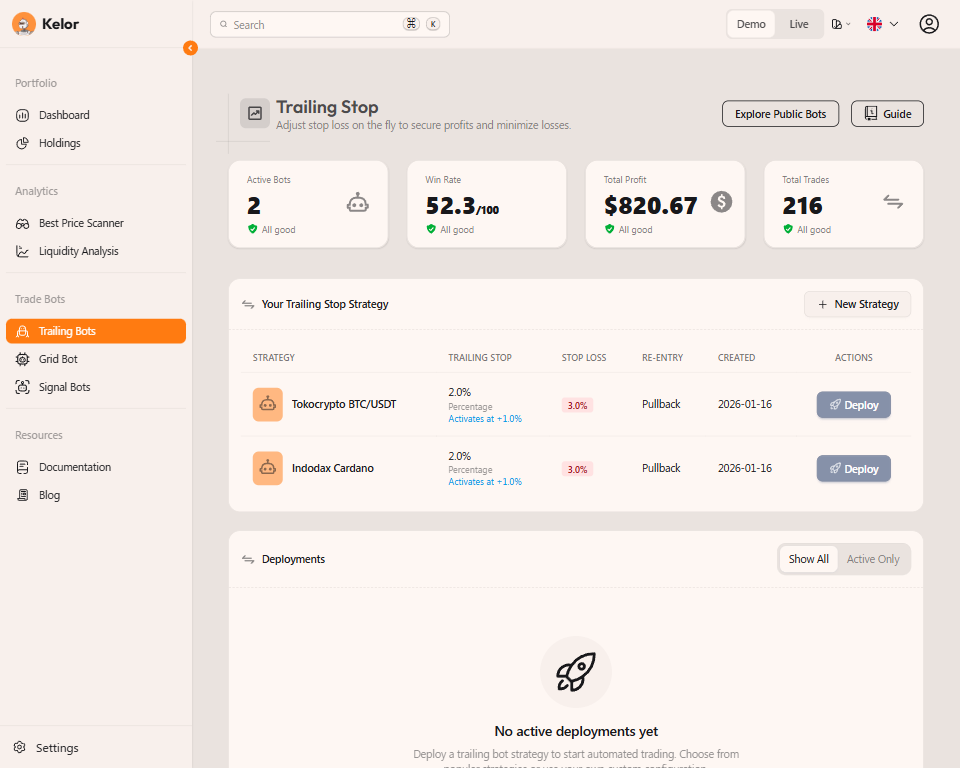

Features Exchanges Don't Always Provide

Many exchanges lack essential risk management and automation tools. Kelor fills these gaps with strategy automation features that help you trade smarter and safer.

Automated Stop Loss

Protect your capital with automated stop losses that execute even when you're not watching the market.

Trailing Stop Strategy

Lock in profits while letting winners run with dynamic trailing stop orders.

Grid Trading Automation

Capture profits from market volatility with automated grid strategies across multiple price levels.

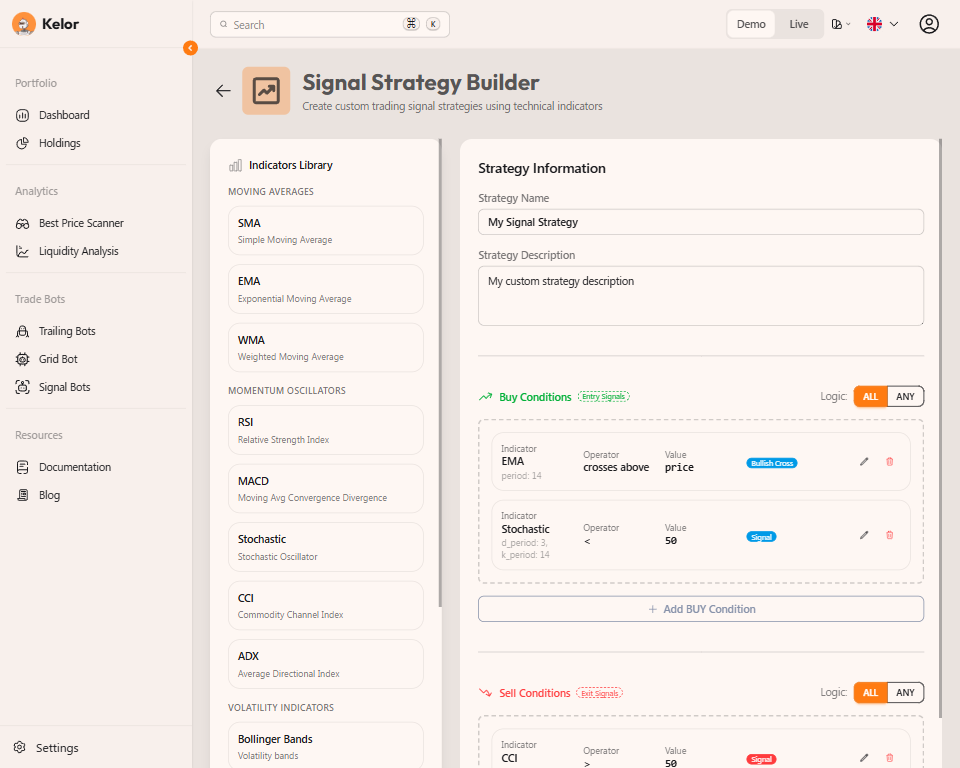

Signal-Based Trading

Execute trades based on technical indicators and custom signals automatically.

Institutional Tools for Everyone

Features that were once exclusive to institutional traders or highly technical users are now accessible to everyone. Test, learn, and refine your strategies without risking real money.

Historical Backtesting

Test your strategies against months or years of historical market data to validate their effectiveness.

Paper Trading

Practice with virtual money in real market conditions before committing actual capital.

Performance Analytics

Get detailed metrics on your strategy's performance including win rate, drawdown, and ROI.

Risk-Free Learning

Experiment with different strategies and learn from mistakes without financial consequences.

Built for Every Type of Trader

Whether you're just starting or actively managing a portfolio, Kelor adapts to your needs

New Traders

Learn with paper trading and backtesting. Compare exchanges to find the best rates and understand market conditions before investing.

Active Traders

Use strategy automation to execute your trading plans consistently. Leverage liquidity analysis and price comparison for better entries and exits.

Portfolio Managers

Track holdings across multiple exchanges in one place. Automate rebalancing and risk management strategies to protect capital.

Start Making Better Trading Decisions

Join traders who use Kelor to gain market insights and automate their strategies

Get Started Free