One Platform. Connect multiple exchanges.

Where you can analyze market. compare prices. monitor portfolios. automate strategies.

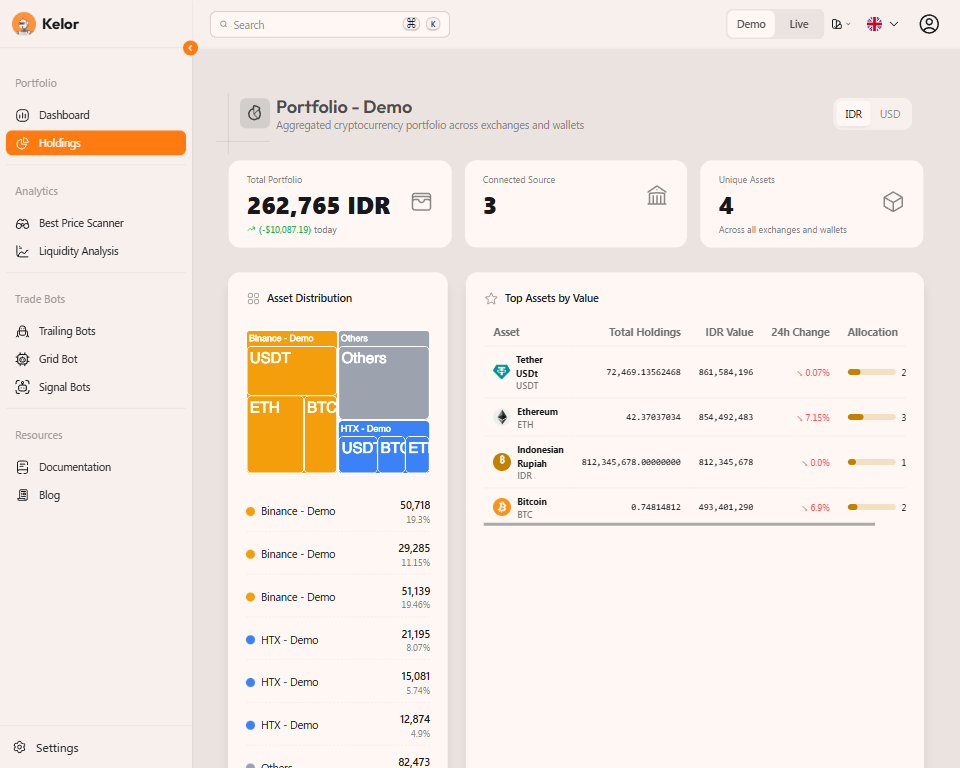

Exchange Balances

| Exchange | Asset | Balance | USD Value |

|---|---|---|---|

Indodax

|

BTC

BTC

|

0.01052 | $680.54 |

Tokocrypto

|

ETH

ETH

|

0.31250 | $589.90 |

Pintu

|

USDT

USDT

|

1,025.00000 | $1,023.85 |

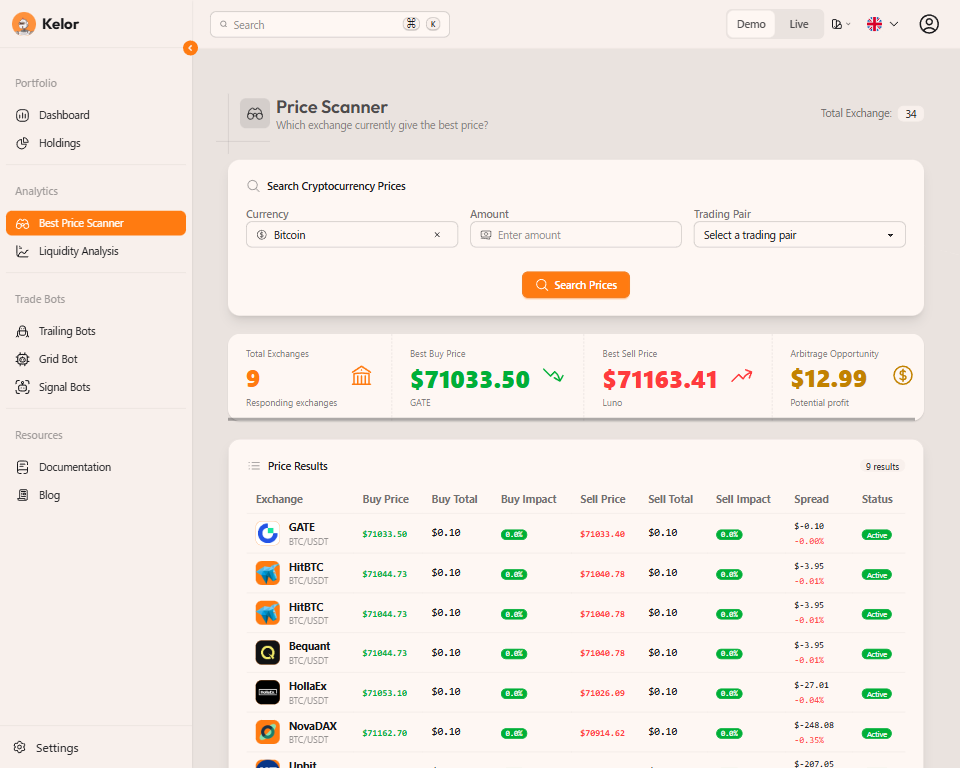

Price Scanner results for BTC

| Exchange | Buy Price | Sell Price | Spread |

|---|---|---|---|

Indodax

BTC/USDT

|

$64,573.57 | $64,851.74 |

$278.17

+0.43%

|

Bittime

BTC/USDT

|

$64,638.26 | $64,767.64 |

$129.38

+0.2%

|

Pintu

BTC/USDT

|

$64,722.36 | $64,916.43 |

$194.07

+0.3%

|

Tokocrypto

BTC/USDT

|

$64,832.33 | $64,638.26 |

$-194.07

-0.3%

|

Signal Explorer

Supported Exchanges

Connect to Leading Exchanges

Indodax

Indodax

Tokocrypto

Tokocrypto

Pintu

Pintu

Be a smarter Trader

Leverage the market competition, find where is the best price and liquidity, and automate your strategy and risk control. Beat the market with us.

Compare Prices

- Real-time Price Comparison

- Multi-exchange Analysis

- Liquidity Monitoring

- Fee Optimization

Portfolio Monitoring

- Unified Dashboard

- Multi-exchange Tracking

- Wallet Integration

- Real-time Performance

Analysis Tools

- 10-year Backtesting

- Paper Trading

- Signal Alerts

- Market Analysis

Strategy Automation

- DCA & Grid Trading

- Trailing Stop-Loss

- Signal-Based Trading

- Custom Strategy Builder

Compare Price and Product

Monitor price, liquidity, and fees from various crypto exchanges to decide the best place to trade.

Real-time Price Tracking

Compare prices across multiple exchanges instantly. Find the best rates and maximize your trading efficiency.

Liquidity Analysis

Monitor order book depth and liquidity to ensure you can execute trades at the best prices without slippage.

Fee Comparison

Compare trading fees, withdrawal costs, and other charges to find the most cost-effective exchange for your needs.

Monitor All Your Assets

Track all your crypto assets in one unified dashboard - from various exchanges to personal wallets.

Unified Dashboard

See all your holdings across multiple exchanges and wallets in one place. No more switching between platforms.

Real-time Performance

Track your portfolio value, profit/loss, and performance metrics in real-time with beautiful visualizations.

Multi-Exchange & Wallet Support

Connect unlimited exchanges and personal wallets. Get a complete view of your entire crypto portfolio.

Automate Your Trading Strategy

Customize the strategy in a way that brings you confidence.

Signal-Based Trading

Execute trades based on custom signals and indicators with fully automated strategy execution.

DCA Strategy

Build positions over time with customizable dollar-cost averaging schedules and smart automation.

Trailing Stop

Protect profits and limit losses with intelligent trailing stop-loss orders that adapt to market movements.

Grid Trading

Profit from market volatility with automated buy-low, sell-high grid orders in ranging markets.

Execute Trades With Certainty

Check, double check, and ensure your trading strategy is robust before you go live.

Backtest Your Strategy

Test your strategies against 10 years of historical market data. See how they would have performed through bull runs, bear markets, and everything in between.

- 10 years of market data

- Detailed performance metrics

- Risk analysis reports

Paper Trade First

Practice with virtual capital before risking real money. Build confidence and refine your strategy with real-time market data.

- Zero risk testing

- Real market conditions

- Track virtual performance

Live Trade with Confidence

Once tested and proven, deploy your strategy live. Our drag-and-drop interface makes it easy to craft and customize your own signals.

- Drag-and-drop builder

- Custom signal parameters

- 24/7 automated execution

Why Choose Kelor

24/7 Automated Trading

- Never miss opportunities

- Emotion-free execution

- Consistent strategy application

Your Funds, Your Control

- Non-custodial architecture

- Secure API connections

- Withdraw-only restrictions

Risk Management

- 10 years of backtesting

- Battle-tested algorithms

- Multiple market conditions

No Coding Required

- Intuitive strategy builder

- Visual workflow designer

- Pre-built templates

Multi-Exchange Support

- Connect multiple accounts

- Unified dashboard

- Cross-exchange strategies

Put Idle Funds to Work

- DCI investing made easy

- Earn yield with staking

- Diversify with crypto funds

Not trading today? Put your idle funds to work.

Kelor isn’t only for active trading — we also help you grow capital with crypto investment products.

DCI (Dual Currency Investment)

Earn yield while setting target buy/sell prices.

Crypto Funds

Diversified exposure through managed strategies.

Staking

Passive income on supported assets.

Frequently Asked Questions

Kelor connects to your exchange via API, allowing you to deploy automated trading strategies without transferring your funds. You maintain full control of your assets while leveraging our suite of trading bots, analytics, and risk management tools.

We never hold your funds. You bring your own API keys from your exchange. Your money stays on your exchange. We can only trade with limited permissions - we cannot withdraw. Even if we're hacked, your funds are safe.

We currently support major exchanges including Binance, Bybit, OKX, and more. We're continuously adding support for additional exchanges based on user demand.

No coding required. Our intuitive visual strategy builder lets you create custom strategies with drag-and-drop simplicity. You can also choose from our library of pre-built strategies.

Yes. Every strategy can be backtested against 10 years of historical market data and paper-traded with virtual capital before you deploy it with real funds.

Markets repeat patterns. By testing strategies through Mt.Gox (2014), the 2017 bubble, 2018 crash, COVID (2020), and the 2022 bear market, we know how they perform in ALL conditions - not just bull runs.

Your funds stay on YOUR exchange - we don't move them to ours. If your exchange gets hacked, it's the same risk as if you were trading manually. But we add extra protection with advanced stop-losses that work even if your exchange doesn't support them.

Ready to Trade Smarter?

Join smart traders who leverage market competition and automate their strategies